The potential for business banking in the US credit union industry

A note from Beneficial State Foundation: In this post, our guest bloggers from the Post Growth Institute explore some of the challenges that credit unions currently face when providing financial services to businesses. Although our bank, Beneficial State Bank, is not a credit union — it is a triple-bottom-line public benefit corporation and B Corp — one of our core initiatives at Beneficial State Foundation is field building, that is, supporting the work of equitable banking advocates who are fighting to ensure financial institutions serve the public interest. This includes solutions to how safe and sound financial services can be delivered to communities that have traditionally been barred from accessing capital, not only for personal needs, but for business creation as well. Credit unions, originally created to protect low-income workers from predatory loans, are one possible vehicle for delivering financial services to these communities.

An increasing number of individuals are turning to credit unions for their banking needs. But what if credit unions in the US were able to better serve larger businesses by offering the same business services found at banks?

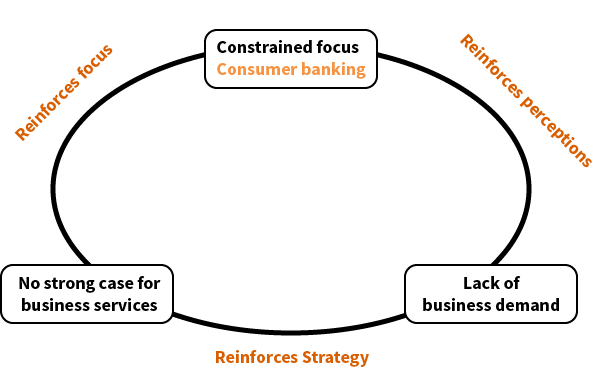

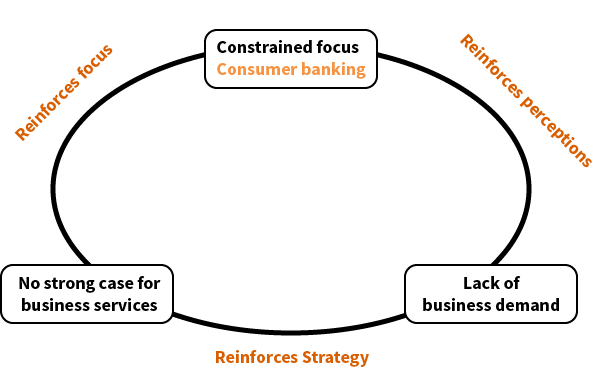

vicious cycle which hold back credit unions from developing Comprehensive Business Services; entrenched loyalties to tradition, the perception of a lack of demand from businesses for credit union membership, and the lack of a strong case for business service development. (Figure 1) Luckily, an intervention at any of these three points offers to reverse the cycle entirely.

vicious cycle which hold back credit unions from developing Comprehensive Business Services; entrenched loyalties to tradition, the perception of a lack of demand from businesses for credit union membership, and the lack of a strong case for business service development. (Figure 1) Luckily, an intervention at any of these three points offers to reverse the cycle entirely.

The Growing Move Your Money Movement

Let’s take a look at the success of credit unions with consumer banking. Thanks, in part, to grassroots-led “Move Your Money” campaigns in 2011, the credit union system has added more than $400 billion of new consumer deposits. Why does this matter? Higher deposits allow credit unions to make more loans and reinvest profits to provide direct benefits to communities through lower rates on lending, higher interest rates on member deposits, and more funds for philanthropic support.Commercial Services in the Credit Union Industry

Credit unions play a vital role in our economy by acting as reliable lending partners to small businesses, the main drivers of real economic growth, ultimately driving the circulation of capital via the multiplier effect. Since the 1980’s, credit unions have seen a dramatic increase in the size and number of loans made to member businesses. A growing minority of credit unions are becoming more responsive to the needs of businesses by expanding their commercial services departments. Some hundreds of US credit unions now offer treasury management and investment services geared for small businesses. The emergence of these services in the industry follows a recent trend of credit unions acting more like banks in terms of service provision. One reason for this is the growing availability of credit union service organizations (CUSO’s) and third-party networks who provide a way for credit unions to outsource many of the internal requirements that are necessary for providing advanced banking services. Still, there remains at least one important distinction between large for-profit banks and credit unions: the absence of a sophisticated suite of business services known as ‘Comprehensive Business Services.’ This includes automated account reconciliation, returned check management, and zero-balance accounts, among other high-level management support services. The absence of these services has prevented credit unions from serving larger businesses with more complex financial needs.Limits to Development: A Vicious Cycle

In an effort to dig deeper, the Post Growth Institute has engaged in an ongoing study which seeks to explain the reasons for this absence. We have found that there are three factors operating in a vicious cycle which hold back credit unions from developing Comprehensive Business Services; entrenched loyalties to tradition, the perception of a lack of demand from businesses for credit union membership, and the lack of a strong case for business service development. (Figure 1) Luckily, an intervention at any of these three points offers to reverse the cycle entirely.

vicious cycle which hold back credit unions from developing Comprehensive Business Services; entrenched loyalties to tradition, the perception of a lack of demand from businesses for credit union membership, and the lack of a strong case for business service development. (Figure 1) Luckily, an intervention at any of these three points offers to reverse the cycle entirely.